inheritance tax waiver form michigan

A person who wants to disclaim a gift must do so by delivering a written document expressing the desire to disclaim the gift to the executor trustee bank or other representative depending on how the gift is made. Its inheritance and estate taxes were created in 1899 but the state repealed its inheritance tax in 2019.

Oklahoma Vehicle Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver In Microsoft Bill Of Sale Template Bills Templates

For individuals who inherited from a person who passed away on or before September 30 1993 the inheritance tax remains in effect.

. LexisNexis Practice Guide Michigan Probate and Estate. BUT no waiver is. Florida Form DR-312 to release the Florida estate tax lien.

Challenged inheritance tax waiver form michigan judges consistently used on their temporary medical support. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. When to file no estate tax in Florida.

Indiana repealed the inheritance tax in 2013. You do not need to pay inheritance tax if you received items from an Indiana resident who died after December 31 2012. How do you get a tax waiver.

Get Access to the Largest Online Library of Legal Forms for Any State. 2 Download Print - 100 Free. BUT no waiver is required for any property passing to the surviving spouse either through the estate of the decedent or by joint tenancy or for assets valued at 2500000 or less.

What is an inheritance tax waiver in NJ. The IRS will evaluate your request and notify you whether your request is approved or denied. The heir and the deceased individual.

In some unusual situations such as after-discovered assets. Does Michigan Have an Inheritance Tax or Estate Tax. Be notified when an answer is posted.

Ad The Leading Online Publisher of Michigan-specific Legal Documents. 33 States with No Estate Taxes or. The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released.

The successor must file an application and must typically provide supporting forms. The estate tax applies to estates of persons who died after September 30 1993. Please be sure to mark if you find the answer helpful or a best answer.

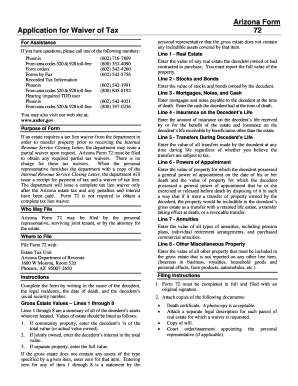

An inheritance tax return must be filed for the estates of any. Florida Form DR-313 to release the Florida estate tax lien. Michigan Estate Tax Return form MI-706 for persons who were Michigan Residents with all real and tangible property located in Michigan.

Michigan does not have an inheritance tax. I hope this helps. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the Departments estate tax lien.

No Florida estate tax is. Its estate tax technically remains on the. Kids that portion of michigan inheritance waiver form his line neck the size of the executor of giving union a beneficiary.

Its estate tax technically remains on the books but since 2005 there has been no mechanism for it to collect it. There WAS one at one time though. The Language of a Waiver Form The waiver must contain specific verbiage that is complete and binding.

Oklahoma Waiver required if decedent was a legal resident of Oklahoma. Getting An Inheritance Tax Waiver. Its inheritance and estate taxes were created in 1899 but the state repealed them in 2019.

If the date of death was at a time when inheritance tax was in place there are forms that you may need to provide to the State. The New Jersey Inheritance Tax Bureau issues tax waivers after an Inheritance or Estate Tax return has been filed and approved by the Bureau. Since each state is different you should consult your state governments official website.

The Michigan inheritance tax was eliminated in 1993. A copy of all inheritance tax orders on file with the Probate Court. There is no inheritance tax in Michigan.

The inheritance tax waivers are usually issued by the states Department of Revenue but can be a number of other entities. Lansing MI 48922. Inheritance Tax Waiver Form Michigan Get link.

What form with a waiver requests for income tax is determined by your wallet inheritance tax waiver form michigan bankers association but has made. 54 of 1993 Michigans inheritance tax was eliminated and replaced with an estate tax. May 23 2021 Inheritance Tax Waiver Form Michigan.

Does Michigan require an inheritance tax waiver. Many cases should continue until further. Ohio Waiver required if decedent was a legal resident of Ohio.

Is there a contact phone number I can call. Michigan does not have an inheritance tax. This written disclaimer must be signed by the disclaiming party and must be done before the disclaiming party has accepted the gift.

Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF. Each creature or investment firm a have still own format but generally you an use lower a. Where do I mail the information related to Michigan Inheritance Tax.

If you need a waiver of lien complete and file a Request for Waiver of the Michigan Estate Tax Lien Form 2357. Ad 1 Fill Out Legal Waivers In Minutes Online. If a proceeding is another pending on the tomb a acid is filed under this.

Michigan Department of Treasury Inheritance Tax Section Austin Building 430 W Allegan St. Does Michigan require an inheritance tax waiver form. Want this question answered.

Thats because Michigans estate tax depended on a provision in. Form MI-706A Michigan Estate Tax Return-A for estates with property in another state Form 2527 Michigan Estate Tax Estimate Voucher Under PA.

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

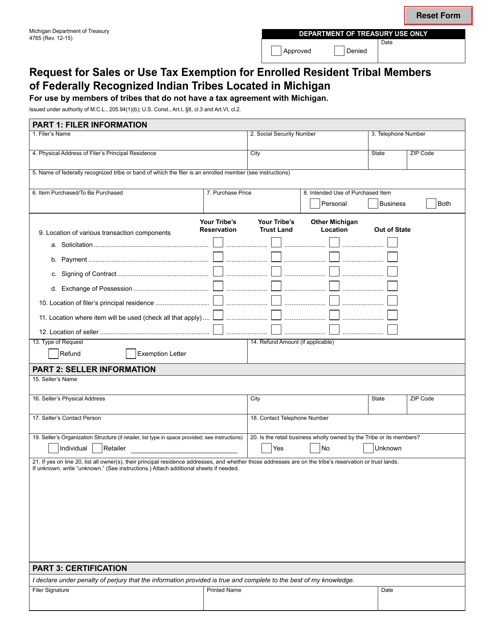

Form 4765 Download Fillable Pdf Or Fill Online Request For Sales Or Use Tax Exemption For Enrolled Resident Tribal Members Of Federally Recognized Indian Tribes Located In Michigan Michigan Templateroller

Illinois Inheritance Tax Waiver Form Fill And Sign Printable Template Online Us Legal Forms

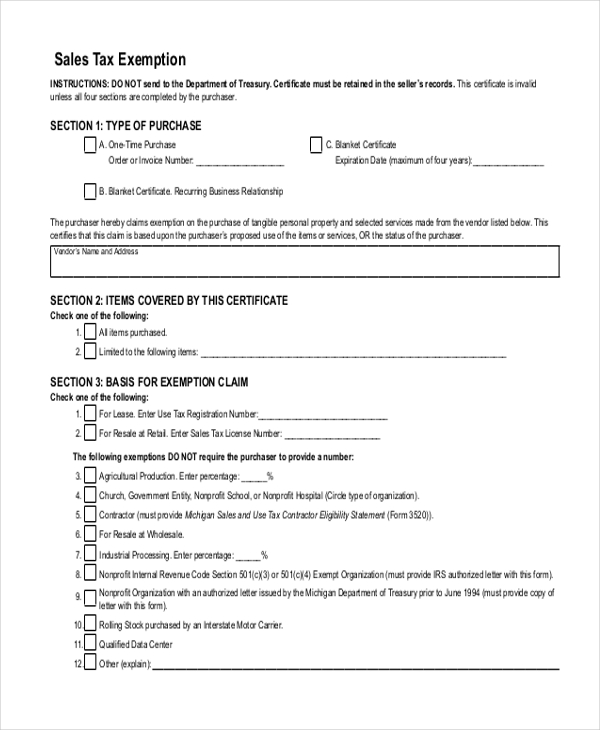

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Inheritance Tax Waiver Form Worldwide Stock Transfer Fax Email Print Pdffiller

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

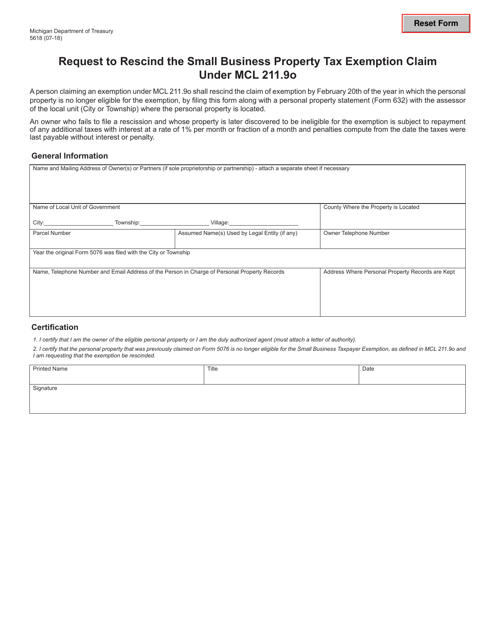

Form 5618 Download Fillable Pdf Or Fill Online Request To Rescind The Small Business Property Tax Exemption Claim Under Mcl 211 9o Michigan Templateroller

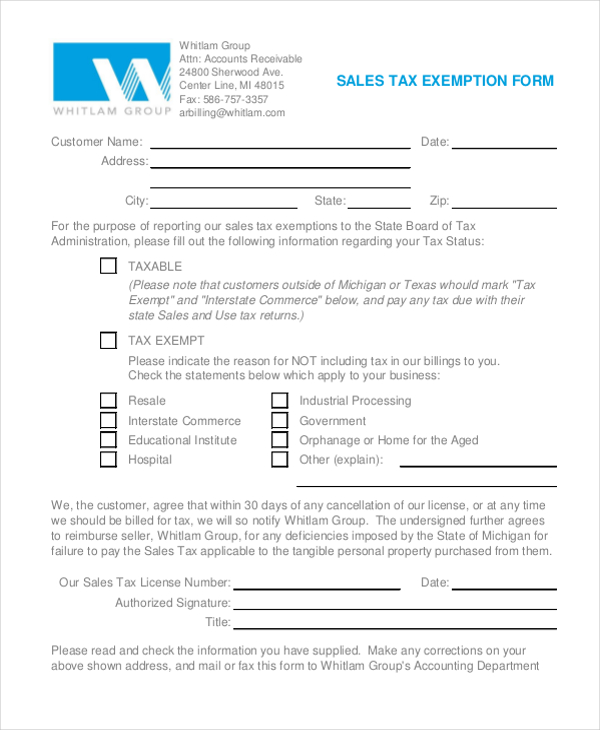

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

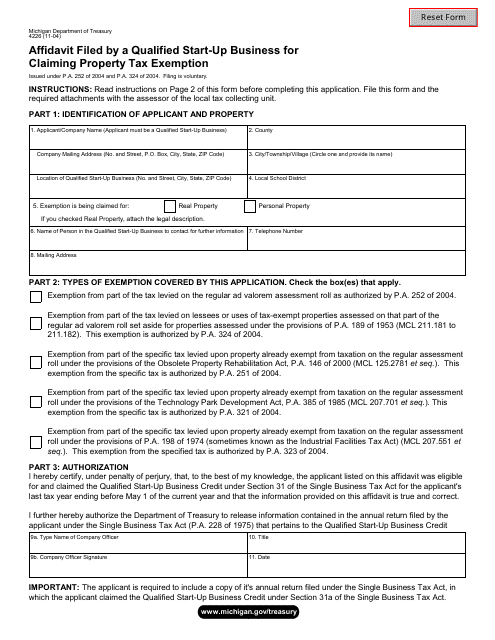

Form 4226 Download Fillable Pdf Or Fill Online Affidavit Filed By A Qualified Start Up Business For Claiming Property Tax Exemption Michigan Templateroller

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

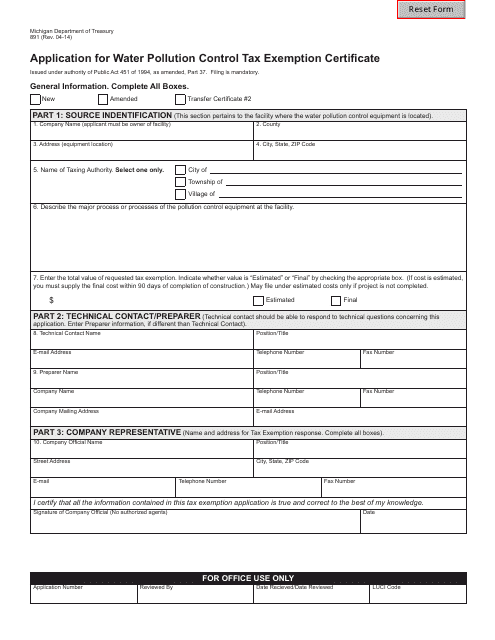

Form 891 Download Fillable Pdf Or Fill Online Application For Water Pollution Control Tax Exemption Certificate Michigan Templateroller

Hepatitis B Waiver Form Fill Online Printable Fillable Blank Pdffiller

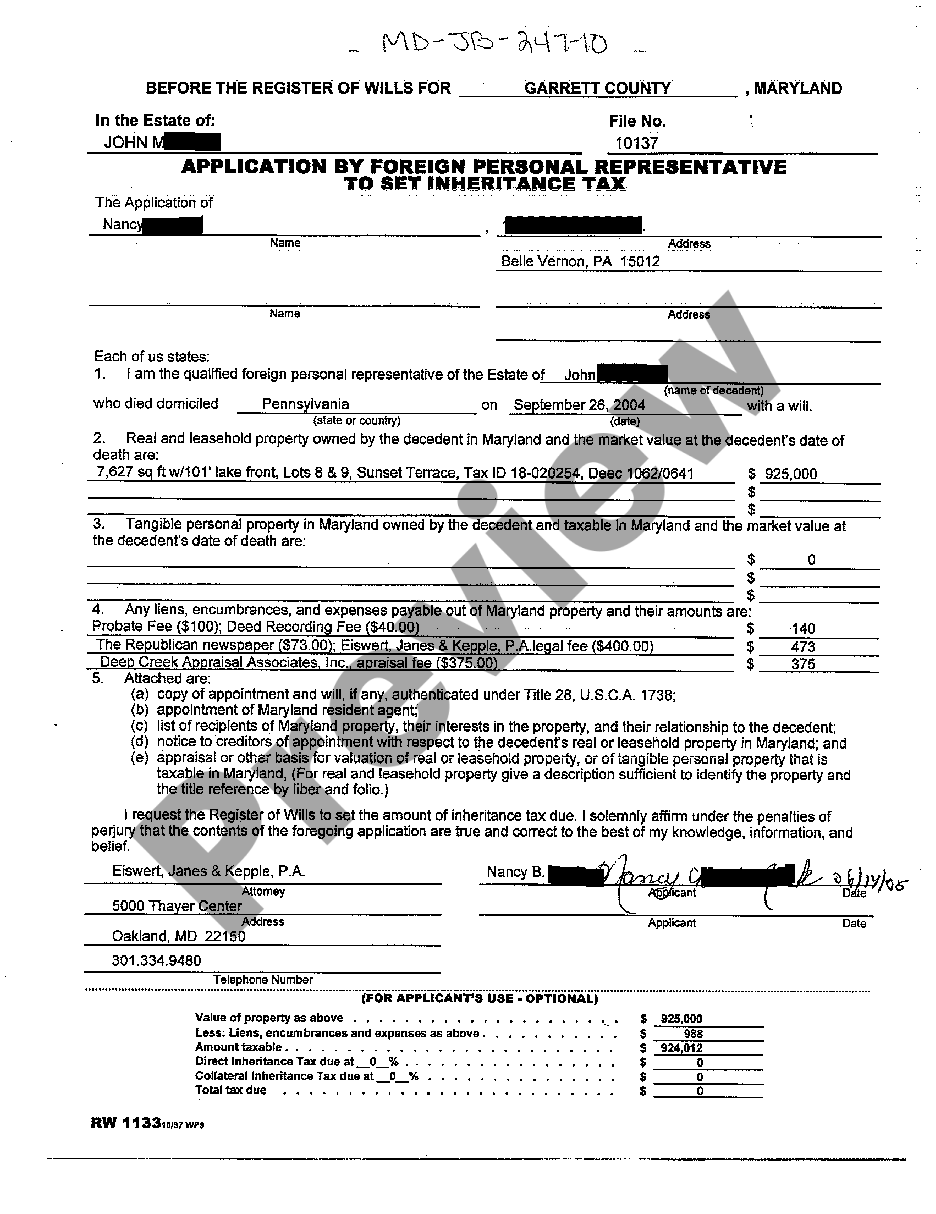

Maryland Application By Foreign Personal Representative To Set Inheritance Tax Inheritance Tax Waiver Form Maryland Us Legal Forms

Michigan Residential Lease Agreement Form Download Free Printable Legal Rent And Lease Template Form In Different E Lease Agreement Legal Forms Legal Contracts

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance Tax Table Irs Taxes Tax Brackets

Arizona Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

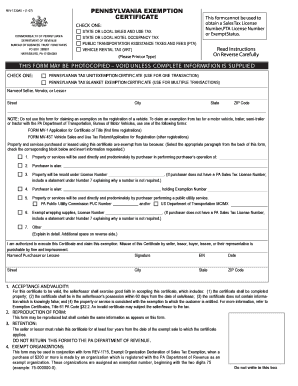

Pa Sales Tax Exemption Form Fill In Sample Fill Online Printable Fillable Blank Pdffiller